Let’s be honest here… everyone likes money. We can have some more freedom in our lives if we have it, and when we retire, all we want is freedom.

Whether you’re 18 or 50, hopefully you’ve already started saving. I know, it’s a lot to think about, but it’s totally necessary. Just imagine how much all that saving will do for you in the future!

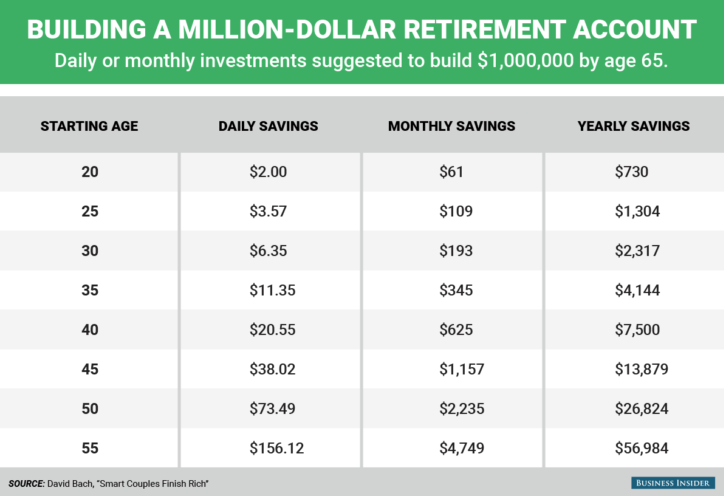

It’s important to know how much saving is necessary per month to reach your goals. I’ve read that everyone wants to have 1 million dollars saved by retirement.

Not only will this fund your life for your golden years, but you’ll be able to say you retired with a million dollar in the bank… worth every penny if you ask me!

So how much do you have to save, exactly? Well, according to Business Insider, it differs for each person based on their age. The younger you are, the less you have to save.

If you’re in your 20s, for example, that’s a prime time to start saving. It seems stupid to save for 40+ years, but trust me, it will pay off in the long run, and it won’t cut into your budget too much!

Just take a look:

Obviously, the earlier you save, the better. So now that you know how much you need to save, it’s time to start saving!

What money-saving tips do you use to get the money you’ll need?